Founders, books, crashes, snow, and strategy

Where I learn a cool new term: Punctuated equilibrium.

This week’s missive is brought to you from across the pond.

For someone that is deeply focused on the digitization of work, it may seem incongruous that I have a particularly and peculiarly deep affection for reading in the analogue. My wife and I treat books as groceries, they are an essential purchase. We are beginning to run out of walls upon which to have bookcases. I also have a vinyl record affliction.

Power failure

I’m working my way through Power Failure, by William Cohan, it’s the history of General Electric. Deep research, delivered with a deft touch, avoiding hagiography.

I’ve found the early years fascinating, especially the parallels with the market crash of 1896. How the commercial founder of GE, Charles Coffin, managed the funding of the business was very innovative, and he groked the power of ecosystems and platforms long before the term were used. The early growth of GE was remarkable in terms of scale and speed. How they weathered the crash of 1896 and the subsequent recession has great parallels for today.

Coffin was a changed man after helping GE to survive the Panic of 1893. Keeping GE far from financial danger thereafter became an obsession with him. "We had a close shave," he said when it was over.

"We were headed for the poorhouse, and the prospect was anything but pleasant. Hereafter we shall cherish no illusions. Our aim, as we strive for expansion, shall be to build up plenty of reserve strength and to maintain it." According to John Broderick, who worked for Coffin at GE, Coffin's "sensations" after the Panic of 1893 "were like those of a commander whose ship has reached port after having encountered a terrific storm and been dangerously close to the rocks. His experience had been a nerve-racking one and he never forgot it. Its effect upon his judgment was permanent."

He observed that when it came to the General Electric Company, financial writers" have a "custom" of describing how conservatively the executives valued the company's assets. "That conservatism was a consequence of the panic of 1893," he continued, "during which a spade was called a spade, and little or no recognition was given to contingent or potential values of any kind. Having kept the enterprise of which he was the chief steward from being totally wrecked, Coffin resolved to make it invulnerable, so far as this was humanly possible." (Somewhat famously, Coffin also coined the phrase when valuing assets on a company's balance sheet, "Use cost or market value, whichever is the lower," an accounting aphorism that has stood the test of time.) Page 29.

SaaS accounting

If you are looking for an excellent source of modern accounting wisdom, do subscribe to

I’m not sure who he or she actually is, but it is top notch.

Snow and the crash of 2023

This week, Jason and I are in Vermont. This is sort of like small scale Davos for our portfolio companies. We have gathered a group of founders together for the Acadian Winter Camp. We think they can learn a lot talking with each other about their challenges and successes. Jason and I have been helping them review strategy, marketing, pricing, scaling teams, hiring, runways and so on. I do at times go on long rambling reminiscences about the early days of SaaS. Jason leads the snow related endeavours and is an excellent cook.

The crash of 2023: A peak founder / VC metaphor here. I managed to crash a snowmobile, with a founder on the back. Luckily, no injuries to humans or damage to the evil device, other than my bruised ego. I may need to strain this metaphor to death in a future post.

Speaking of strategy

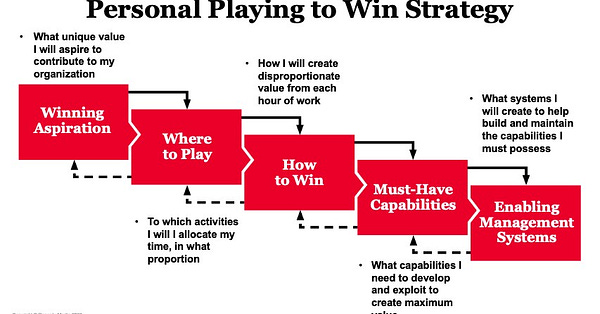

When I think of strategy, I often return to the work of Roger Martin. This is an excellent video, and if you read any article on strategy, read the Strategy Trap.

He is also pretty damn spot in in terms of career advice.

A visualization of the recruitment technology space

My former employer Gartner has significantly boosted its HR Tech focus since the days of the merry band of Holincheck, Padmanabh, Motoyoshi, Freyermuth, Pang, and Otter. Here is a recent infographic on the state of recruitment tech. It is called the Recruiting Innovations Bullseye. It is based on interviews with a relatively small set talent acquisition leaders, but nevertheless, still very useful as a visualization of the breath of recruitment tech.

A remarkable curated compendium

David Green’s newsletter is a remarkable curated compendium of workforce analytics and broader future of work research. You can lose yourself for hours in this..

Showcasing the articles that comprise my two-part collection of the 60 best HR and People Analytics articles of 2022. See:

Part 1: https://lnkd.in/gXFkVG3y

Part 2: https://lnkd.in/gUwaUAYD

David linked to Andrew Marritt, who probably knows more about analysing text for sentiment and insight than anyone I know. As I figure out LLM, GPT3 and ChatGPT I intend to lean on Andrew.

Punctuated equilibrium

Speaking of LLM, you should really get a coffee and a comfy chair and read Stephen O’Grady’s long piece on how technology disruption is not linear. It is insightful, and he writes so well.

In evolutionary biology, there’s a hypothesis called punctuated equilibrium. In simple terms, the theory posits that evolution follows a path that is not a process of gradual, incremental change over millennia, but typically a static process irregularly punctuated by periods of rapid change.

Over the years I’ve learnt so much from the Redmonk gang.

One last thing

A hit from 1988.

Re recruitment visualization, your friends at Gartner are missing Offer Management.

And agree the snowmobile metaphor should run deep. ❄️

Thanks for the shoutout - I am enjoying learning from your posts as well!