Jason and I know a lot about SaaS. Not as much as Dave Kellogg, but we have some of the scars. I can bore for Germany on the nitty gritty of HR tech in the cloud. I can drone on for hours in numbing detail about technical debt and scaling pain. Jason helped build one of the most impressive HR tech SaaS businesses, Cornerstone. We have a deep well of stuff we know, and generally know people who know stuff when we don’t.

At SAP SuccessFactors in 2016-18 we experimented with AI, and I saw the tantalizing opportunity, but we failed miserably to move it beyond the lab (a story for another day). I’ve followed the efforts of many other vendors through various phases of marketecture, and occasionally beyond that into real product.

I’ve advised AI based start-ups for the last 8 years or so, Clustree, Maki, Techwolf and more. At Acadian we have invested in several companies with deep AI focus, including Techwolf, Fifty and most recently Fora. We will be announcing a new AI focused deal shortly.

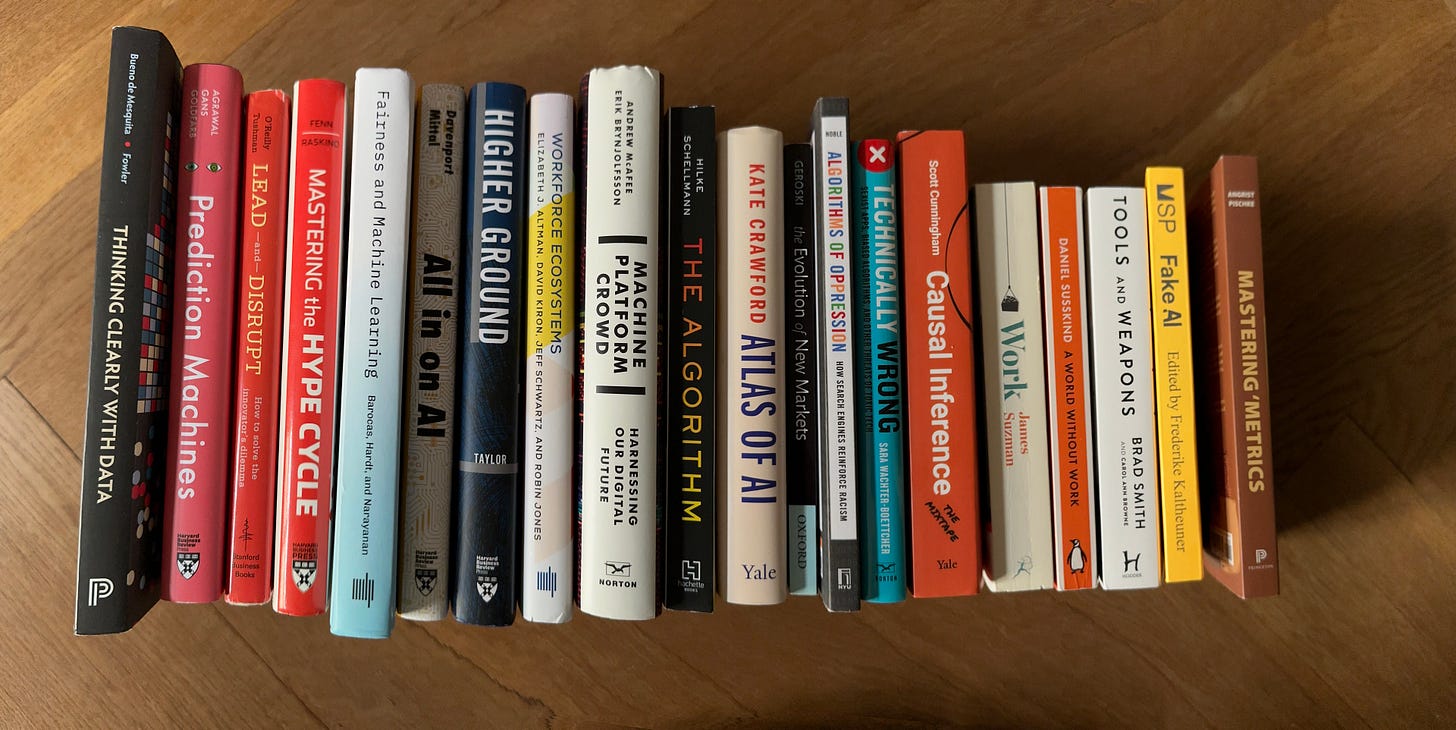

I’ve learnt quite a bit, especially from Jeroen at Techwolf about the workings of AI, but I realised about a year ago that I need to seriously strengthen my fundamental and applied AI competence. And I’ve been reading lots of books, blogs and academic articles, and listening to a few podcasts too.

I’m not a believer in investing in something you don’t understand. I should be able to talk with founders from a position of some knowledge. This is important in due diligence, but it is also key if you want to give them any meaningful post deal advice beyond good governance and your network.

For the last couple of months I’ve been doing no-code ML/AI course via MIT/ Great learning. It has been good to actually understand what a random forest does, as well as clustering methods, neutral networks, forward propagation, sigmoids and other building blocks of structured and unstructured ML. I’ve grappled a bit with calculus (exploding gradients anyone?), attacking some deep maths trauma from my youth. Calculus won, but I’m getting there. I’ve been using Dataiku, which is a fabulous product, great UX, impressive support, and a robust responsible AI position. I have no plans to be a data scientist, but I now have a far greater respect and understanding of what they do. I’m aiming for AI fluency.

Back to Saïd.

Q: How do you know someone is at Oxford?

A: Don’t worry they will tell you.

This week I’m back to the University of Oxford (Saïd Business School), for the first module of the PGDip in the Business of AI. A couple of years ago I did the PGDip Strategy and Innovation, and it was during that course that I began my transition to Venture Capital.

There are several reasons why investing the time and money in this makes sense.

It is fun and a deep privilege to go and hang at one of the world’s finest academic institutions. So much history to soak up. And nice dinners in elegant buildings. I get to tell everyone I’m reading AI at Oxford. I get to buy a college fleece.

I’ll learn a lot about the latest research and application of AI to business. This will help us evaluate and advise our investments. I’m very curious to see how AI is going to change business models. SaaS changed the software business model, but that was 20 years ago. What’s next? How will the regulatory environment create or hinder investment opportunities?

While we aren’t fundraising now, it strengthens our long term positioning to potential LPs.

The cohort is likely to be an interesting source of start-up deal flow and a powerful network. The whatsapp group is already busy. If the DIPSI is anything to to go by, I’ll learn heaps from others, and I’ll make some friends too.

I’ll also get a good sense of how executives in larger companies are using or planning to use AI. How will enterprises buy AI might be different from how they buy SaaS, for instance.

There is an active start-up and innovation community at Oxford and spending time there will help me tap that more effectively.

I hope to connect with faculty and in turn connect them with our portfolio companies. There is a lot of specific Future of Work related research that is in our sweet spot, both at the business school and in the broader university.

Having another chance to learn from Marc Ventresca is a privilege. Re-engaging with innovation theory: Schumpeter’s schöpferische Zerstörung, Utterback’s dominant design, Ansoff’s matrix, Santos and Eisenhardt’s Claim Define Control, Geroski’s inchoate demand, ferment, technology as a bundle of possibilities, O’Reilly and Tushman’s Exploit and Explore, Felin’s value model and Zenger’s firm theory model, Jacobides on ecosystems and the firm boundaries, Roth on intermediaries and more is a happy place for me. And then throw in a bit of Thomas Hobbes.

You might like to read this: Ventresca, M., Scataglini, M and Seidel, V. (2021). Four innovation precepts for leaders in the 'Long Now'. View Online Wouldn’t it be lovely if all business research was written this eloquently?

I’ll post about what I learn after each module. We (the cohort) are a diverse bunch, but we all have high expectations for the course. There is so much great research going on at Oxford beyond the business school, for instance at the Oxford Internet Institute, and I am looking forward to getting exposure to that. It will be fascinating to see how Felipe Thomaz and his colleagues pull all these strands together over the year.

I’m on campus once a quarter for a week, and there are papers to write in between. I will owe a debt of gratitude to Jason and Charlotte for encouraging.my academic indulgence.

As is my usual practice, here is a tune. The brilliant Fiona Apple covering the brilliant Waterboys’ magnificent, The Whole of the Moon. Marc is one of those rare people that sees the whole of moon.

*

great read Thomas, makes me humble how

much I can still learn and how an academic break can indeed be of such a high value add in our rushed Tech lives.